Flooding is the most common and costly natural disaster in the United States, causing billions in annual economic losses. According to the National Flood Insurance Program (NFIP), 90% of all natural disasters in the United States involve flooding. When it comes to lifting out citizens out of these natural disasters FEMA is falling us.

The NFIP is a federal program created in 1968 that tracks flood-related natural disasters and provides insurance. They pay out to property owners and renters in communities with a high risk of flooding. The program is run by the Federal Emergency Management Agency (FEMA). And it has spent tens of billions of dollars rebuilding homes after significant floods and storms. However, due to mismanagement and shortsighted policies, it has turned into a leech on our country.

The program is funded by extremely low premiums paid by policyholders, while federal taxpayers cover the rest. The NFIP is the only source of flood insurance for millions of Americans because private insurers quickly figured out there was no way this kind of insurance could ever be profitable or sustainable. The NFIP is currently $23 billion in debt, which is expected to grow in the coming years.

How many decades will it take the U.S. government to realize that this system cannot last?

Incentives and Repetitive Losses: What’s in It for FEMA

The problem that has plagued the NFIP since the very beginning is one that’s solvable. But a system that exchanges low-premiums for subsidized bailouts encourages millions of Americans to stay in homes that are in flood-prone areas. The NFIP does not have the legal authority to manage costs by refusing coverage or dramatically increasing rates. Which allows for excessive claim properties or “Repetitive Loss Properties (RLPs).”

FEMA defines an RLP as “any insurable building for which two or more claims of more than $1,000 were paid by the National Flood Insurance Program (NFIP) within any rolling ten-year period.” Since the NFIP’s inception, RLPs have made up around 1% of properties insured by the NFIP, but cumulatively, they have accounted for over 30% of payment claims. Across its lifespan, the NFIP has paid $22.2 billion in claims to RLPs.

Due to these handouts, there is no reason for owners to leave their properties as they are incentivized to stay in high-risk areas. There should never have been homes in these places to begin with, but now taxpayers are forced to fund their rebuilds over and over again.

Subsidizing the Rich

Another rotten element of the NFIP is that it unnecessarily subsidizes affluent homeowner’s intentionally risky properties. Regardless of their economic status or property value, homeowners in flood-prone areas can get insurance for below-market rates. Wealthy homes and 2nd homeowners intentionally buy high-value properties in flood-prone areas. This is because they know they will be damaged and that they will rebuild them on the government’s dime.

This is especially insulting to the Americans who are trapped in properties that are not desirable and can’t be sold. Many victims of flood-related disasters are stuck subsisting on government payouts because there are no private buyers, and the NFIP has a severely underutilized system of buyouts. They would leave if they could get at least something for abandoning their homes, but due to abuse by high-value properties bleeding FEMA coffers, the NFIP doesn’t have the resources to help them.

This system keeps low-income renters and homeowners captive in regularly flooded and destroyed properties. This keeps several corrupt industries make billions. The only people who gain from these yearly natural disasters are the insurance companies. They get massive government rebates. Real estate agents, either intentionally advertise the loopholes or hide the flood-prone nature of properties. Hardware stores like Home Depot and Lowes sell out after every hurricane or flood disaster also making millions.

A Planet in Turmoil and FEMA Won’t Help

The planet is in turmoil, and we cannot afford to pay the price.

We are seeing this price being paid right now in Florida after it was devastated by Hurricane Ian. Besides the massive impending economic cost of rebuilding thousands of homes, there is also a significant loss of life. Estimates put the death toll at over 100 people. How many of those people live in homes they couldn’t sell, or in areas that the NFIP knew were dangerous? The damage is already done, and more is on the way.

FEMA has shown once again that the NFIP is a failing program and has no intention of changing. Here is FEMA administrator Deanne Criswell’s flimsy response to concerns about the future of the program and the perpetual rebuilding cycle for many at-risk homes: “When individuals are starting to make decisions about what they are going to do and what their next steps are, they really need to understand what their risk is.”

No Forward Thinking When Relying on FEMA

The attempts to push the responsibility onto “individuals” to make the decision is useless. Owners have failed to make the right decision since the 1960s when the first flood risk property maps were drafted. Trusting millions of Americans to voluntarily stop abusing government handouts is completely unrealistic. When a significant portion of our country doesn’t even believe climate collapse is real, why would you expect them to change anything to account for it? Even the NFIP knows this strategy doesn’t work and said as much back in 2017. Here is a quote from the administrator at the time: “[FEMA] presumed that if we told people they were at risk, they would move. They presumed that over the program’s life, those discounts wouldn’t need to be continued… because once people knew they had the risk, they would move out. That has not proven true.”

If this strategy of simply informing buyers and trusting them to make the right decision would have worked. Thousands of people would be alive still, and it would have happened a long time ago.

FEMA Administrator Criswell also uses the decades-old claim that by improving building standards, we can somehow negate the effects of hurricanes: “Florida has done an amazing job of putting in place stricter and stronger building codes, to make sure that as we rebuild, we rebuild more resilient.”

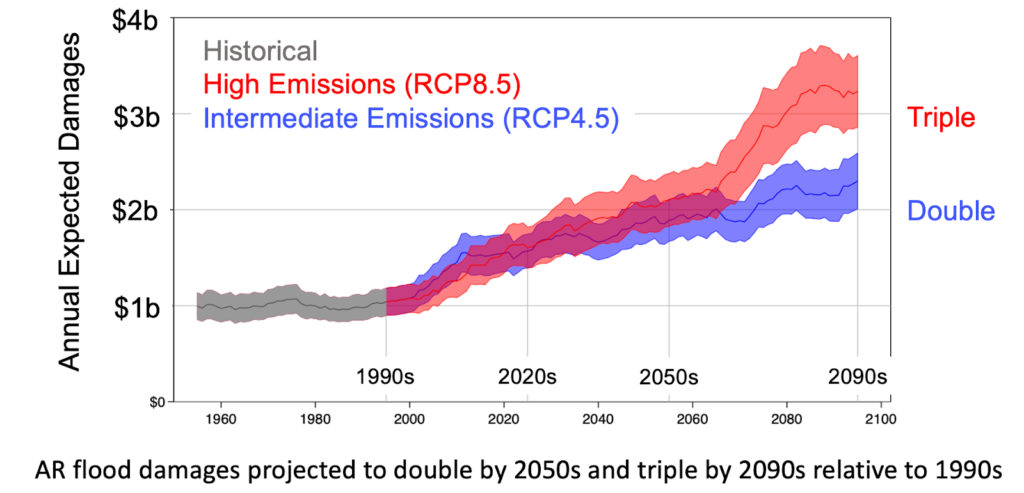

While the NFIP makes efforts to prevent property damage due to flooding, the program is not reducing the cost. Flood-related disaster cost a lot to fix and they know that. Regardless of their preventative measures, the NFIP is trying to hold back the ocean with a broom.

Babcock Ranch

Remember, a wise man builds on a rock, and a fool builds in the sand.

This was recently demonstrated in the juxtaposition of two cities hit by Hurricane Ian on the coast of Florida. Babcock Ranch is just 12 miles inland from Fort Myers, which was directly in the path of Hurricane Ian. And because of this they were one of the hardest-hit cities in the state. However, despite the devastation it caused to the neighboring city, Babcock Ranch survived Hurricane Ian relatively unscathed. The carefully planned community first opened in 2018 and is located on a higher piece of land than the rest of the city, which helped it avoid the worst of the hurricane’s damage.

Sand over Stability

Residents of Babcock Ranch recognize and appreciate the unique situation they are in. One resident, Anthony Grande, moved away from Fort Myers three years ago in large part because of the flooding risk. Hurricane Ian proved the need for him to move out of his previous high-risk property. Grande was clear about what he felt was the future of the Florida coastline, “In the times that we’re living in right now with climate change, the beach is not the place to live or have a business.”

Another resident of Babcock Ranch, Nancy Chorpenning, also saw the writing on the wall and is seeing the effects of Floridians hit by the storm. She is finally recognizing the danger they are in. Speaking about the effects of Hurricane Ian on the region, she noted, “We may be the only people in southwest Florida whose property value just increased.” This kind of inland, high-above-sea-level residential and commercial development is a model for mitigating the long-term effects of climate disaster and the increasing number and severity of natural disasters.

Buyouts Not Handouts

While the private sector adapts to new demand for these types of properties, the NFIP needs to stop all insurance payments to houses in flood-prone areas. Their money would be better spent if they directed it to one-time buyouts by FEMA for affected people. These buyouts should be for low-income homeowners and not extend to any 2nd homeowners. As soon as we stop incentivizing Americans to live in these doomed areas, the rich will leave, and the poor will be given a route to escape.

It is time to say that property owners in flood-prone areas can either take their money and leave now or personally pay to rebuild their homes as they are swept away by the rising tide and ever-intensifying extreme weather events.

George Freeman,

Presiding Chaplain Universal Life Church Monastery